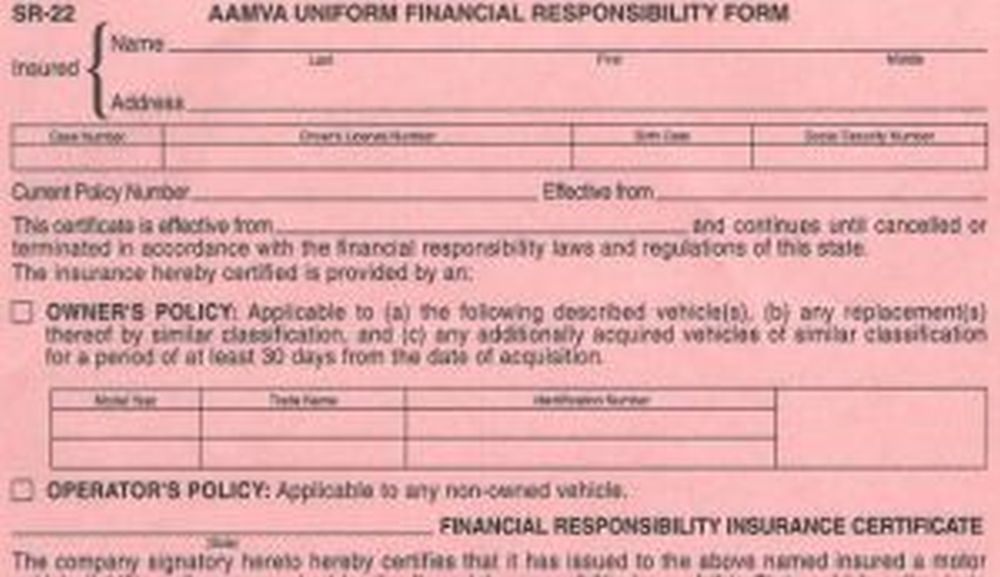

SR-22 insurance is a special type of auto insurance which is primarily designed to meet the requirements of high-risk drivers. It is a certificate that must be filed with the Texas Department of Public Safety and officially proves that a driver has taken out insurance that meets all of the state’s minimum requirements. Here is a comprehensive look at the SR-22 insurance requirements in Texas so that you can be prepared when it comes to obtaining coverage.

To start off, it is important to understand that an SR-22 certificate does not replace car insurance. It simply proves that you have obtained a valid policy. So, if you are convicted of a driving offense that requires you to file an SR-22, you will need to purchase an auto insurance policy from a company that is licensed to do business in Texas. It is also important to note that most insurance companies will require you to pay an additional fee for the SR-22 filing.

In order for your policy to qualify for an SR-22 filing, it must meet the minimum Texas requirements. This includes a minimum of $30,000 per injured person, up to a total of $60,000 per accident, and $25,000 for property damages. Furthermore, your policy must also include personal injury protection and uninsured/underinsured motorist coverage. These are mandatory requirements in order for your policy to be accepted.

Once you have purchased a policy that meets all of these requirements, you must contact your insurance company and ask them to file an SR-22 on your behalf. The insurance company will then forward the form to the Department of Public Safety and, upon approval, your SR-22 will become active. During this time, you must maintain your insurance policy for at least three years. Failure to do so will result in your license being suspended.

Having an SR-22 on file is not only a requirement that must be met in Texas, but it can also have a significant impact on your insurance rates. This is because having an SR-22 is seen as a high-risk activity. Therefore, you can expect to pay higher premiums for the duration of your SR-22 filing.

Finally, it is important to understand that an SR-22 is not available in all states. Therefore, if you are planning to drive in another state, you must make sure that the appropriate paperwork has been filed and that your license is valid. Otherwise, you could find yourself in serious trouble.

Aside from meeting the SR-22 insurance requirements, it is also important to understand the different laws that must be followed in the state of Texas. For example, anyone caught driving under the influence (DUI) of alcohol or drugs will face serious penalties that could include jail time and hefty fines. In addition, it is illegal to drive without a valid license, regardless of whether or not you have an SR-22 on file. Taking the time to familiarize yourself with the laws in your state can help you to stay out of legal trouble.

Furthermore, some drivers with an SR-22 on file may discover that it restricts their ability to drive certain vehicles. This is because some car insurance companies will refuse to insure drivers with an SR-22, which could prevent you from operating a high-powered sports car, a limousine, or any other vehicle that is perceived to be a risk. Thus, it is important to thoroughly research your policy limitations before making a decision.

Another important consideration is that the terms of an SR-22 filing can differ from company to company. This means that you could end up paying more money with one company than you would with another, so it is important to shop around and compare policies before selecting one. Additionally, some companies may be more lenient about SR-22 policies for drivers with a high-risk level; Furthermore, some insurers may offer special discounts for drivers with an SR-22 filing.

Finally, it is important to note that you may be able to have your SR-22 filed electronically. This can be easy and convenient, and it can greatly speed up the process of obtaining an SR-22. Furthermore, the filing can be done from anywhere, so it is important to explore this option if you need an SR-22 quickly.

Now that you have a better understanding of the SR-22 insurance requirements in Texas, it is time to look at ways to save money on your insurance policy. Doing so can help to lessen the burden of meeting the minimum requirements, so let’s take a look at how you can do that.

First, it is important to understand the different discounts that are available in Texas. For example, some insurance companies offer a multi-car discount, which can be quite helpful if you have multiple vehicles in your household. Additionally, some insurance companies provide a military discount for active-duty, retired, or veteran members of the US Armed Forces.

In addition, Texas provides a good-driver discount for drivers who have gone at least three years without making any insurance claims or receiving any moving violations. This can drastically reduce the cost of your annual premiums and can help to offset the extra cost of SR-22 insurance.

If you own a security system or have taken a defensive driving course, it is also worth asking about any discounts that may be available for those activities. These types of discounts will vary from company to company, so it is important to research the offerings in your area.

Furthermore, some insurance companies in Texas provide packages that bundle multiple types of policies together. This can be a great way to save money if you need more than one kind of policy, such as auto and home. Furthermore, some companies can offer discounts of up to 30% if you bundle multiple policies together, so it is definitely worth considering.

Finally, it is important to ask your insurance provider about any special discounts that they may offer. For example, some companies provide discounts on long-term policies or a loyalty discount for customers who have been with them for a long period of time.

Overall, there are many ways to save money on insurance in Texas and these tips will help you to reduce the burden of requirement, so that you can meet your SR-22 insurance coverage requirements without spending too much.

When it comes to finding the right SR-22 insurance policy, it is important to compare prices and policies before making a decision. Even minor differences in coverage and rates can have an impact on the total cost of your policy. Furthermore, it is important to make sure that the policy meets all of the state’s minimum requirements. Then, once you have chosen the policy that is right for you, make sure to ask your insurance company to file an SR-22 form on your behalf, so that you can remain in compliance.

Having an understanding of the laws, the costs, and the different types of discounts that are available is essential when it comes to selecting an SR-22 insurance policy. Fortunately, there are many resources available that can help you to make the most informed decision. Whether you decide to purchase insurance through your current provider or shop around for a new policy, doing your research and asking questions is the best way to ensure that you are making the right choice.

Now that you have a better understanding of SR-22 insurance requirements in Texas, it is time to start the process of selecting a policy. Remember, the most important factor is to ensure that the policy meets all of the necessary requirements and fits within your budget. Spending some time researching your options will pay off in the end, as you will be able to find a policy that meets your needs and allows you to remain in compliance with the law.