Unearthing the Easiest Way to Get SR-22 Insurance in Texas

texas is a great place to live in and is known for its diverse population, diverse culture, and friendly atmosphere. But it is also known for its strict car insurance laws, especially when it comes to SR-22 insurance. Drivers must carry SR-22 insurance in order to stay in compliance with the law – but the process of getting it can often be confusing and intimidating. Thats why were here! Our goal is to help make the process of getting SR-22 insurance in Texas as easy and stress-free as possible.

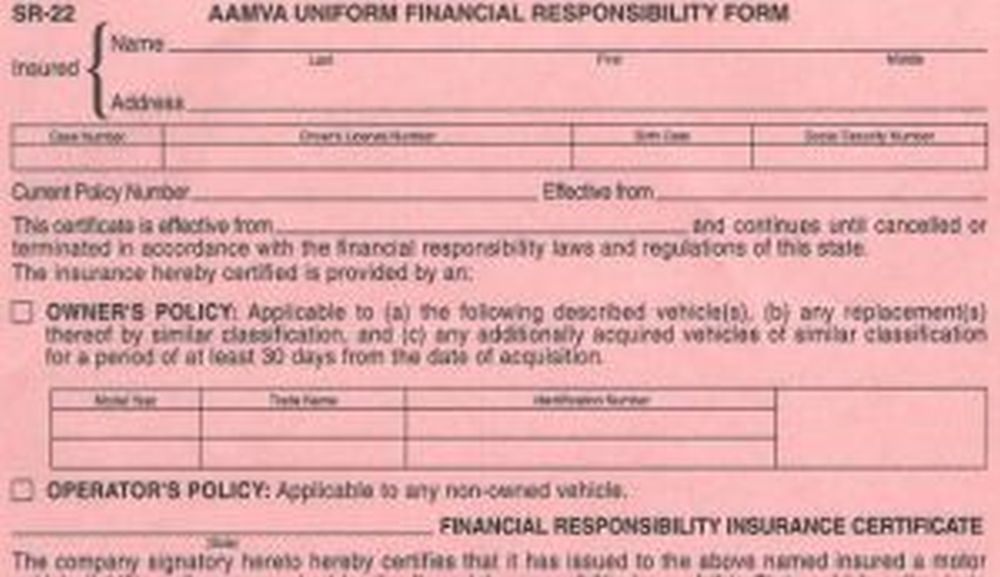

So, what is SR-22 insurance? SR-22 is a proof of auto liability insurance, which is required by certain drivers. It is a document that your car insurance company will file with the state to demonstrate that you are carrying a certain amount of car insurance coverage. Generally, you will be required to carry SR-22 insurance if you have been involved in a car accident or ticketed for certain offenses, such as a DUI.

It is important to understand that SR-22 is not an insurance product itself, but a document that proves you carry adequate insurance coverage. Thats why it is often called a certificate of financial responsibility. To get SR-22 insurance, you can usually obtain it from your existing car insurance company – all you need to do is make a few phone calls and tell your insurance company that you need an SR-22 filing.

But that can sometimes be easier said than done. Many drivers are overwhelmed by the process and dont know where to begin. So, weve created this quick and easy guide to getting SR-22 insurance in Texas.

First, youll need to find a reputable car insurance company in Texas that offers SR-22 policies. Youll want to compare quotes from several different companies to make sure youre getting the best deal. Keep in mind that SR-22 policies are different than regular car insurance policies, so youll want to make sure youre getting the coverage you need at a price you can afford.

Once you have chosen a car insurance company, youll need to contact them and let them know that you want to purchase SR-22 coverage. The insurance company will then file the SR-22 certificate with the Texas Department of Motor Vehicles on your behalf. Some companies may charge an additional fee for the filing, so be sure to ask before you sign up.

When the SR-22 has been filed, youll need to maintain continuous coverage for a certain period of time. Usually, this is three years but it can vary depending on your specific circumstances. If you allow your coverage to lapse during this time, then the filing will be revoked and youll have to start the entire process over again.

Thats all there is to it! As long as you keep up with your payments and maintain continuous coverage for the required amount of time, you should be in compliance with the SR-22 insurance laws in Texas.

Now that youve got the basics down, lets take a closer look at the specifics of getting SR-22 insurance in Texas. What kind of documents do you need to provide? What is the process for filing the insurance documents? Well answer these and other important questions here.

In order to get an SR-22 filing in Texas, youll need to provide the insurance company with certain documents. These may include proof of identity, proof of residence, a copy of your drivers license, and your current auto insurance policy. The insurance company will use these documents to verify that you are a qualified driver and that you meet the states insurance requirements.

Once you have gathered all of the necessary documents, youll be ready to start the actual filing process. Youll need to contact the insurance company and let them know that you need an SR-22 filing. The insurance company will then file the appropriate paperwork with the Texas Department of Motor Vehicles. This can usually be done over the phone, but some companies may require you to visit their office in person to complete the paperwork.

Once the paperwork is filed, youll need to maintain the SR-22 coverage for the required amount of time. This is usually three years, but it can vary depending on your specific circumstances. During this time, you must remain a qualified driver and maintain continuous coverage. If you allow your coverage to lapse at any time, then the filing will be revoked and youll have to start the entire process over again.

Now that youve got the basics down, lets move on to the specifics. How can you find the right car insurance company to provide SR-22 coverage? What other factors should you consider when shopping for SR-22 insurance? How can you ensure that you are getting all of the coverage you need? Well answer these and other important questions here.

Finding the right car insurance company to provide SR-22 coverage can be a bit tricky. Youll want to be sure to compare quotes from several different companies in order to get the best deal. Keep in mind that SR-22 policies are different than regular car insurance policies, so youll want to make sure youre getting the coverage you need at a price you can afford.

Once youve narrowed down your choices, youll want to do some research. Read online reviews and ask friends and family for recommendations. Youll also want to make sure that the company is reputable and has an A.M. Best rating of A- or better. Make sure that you understand all of the terms and conditions of the policy before you sign up.

Finally, ask the insurance company about any discounts they may offer. Some companies may offer discounts for good drivers or for bundling policies. Be sure to ask about any discounts you may be eligible for and make sure to get any discounts in writing.

Getting SR-22 insurance in Texas doesnt have to be a difficult process. With a little bit of research and preparation, you can be sure that you are getting the coverage you need at a price you can afford. So, now that youve got the basics down, why not get started on your search for SR-22 insurance in Texas? With the right company and the right coverage, you can be sure youre getting the peace of mind you need.

Now that you have an understanding of the basics of getting SR-22 insurance in Texas, let’s explore some other aspects of the process. What kind of documents do you need to provide to the insurance company? What is the process for filing the SR-22 papers? What should you look for when shopping for SR-22 insurance? What other factors should you consider when looking for SR-22 insurance?

When you are looking for SR-22 insurance in Texas, the first thing you’ll need to do is contact your current insurance company and ask them if they provide SR-22 insurance. If they do not, you’ll need to shop around for other insurance companies that offer SR-22 policies. You’ll want to compare quotes from several different companies to make sure you’re getting the best deal. Keep in mind that SR-22 policies are different than regular car insurance policies, so you’ll want to make sure you’re getting the coverage you need at a price you can afford.

Once you’ve found an insurance company that meets your needs, you’ll need to provide the company with certain documents in order to file the SR-22 papers. These documents may include proof of identity, proof of residence, a copy of your driver’s license, and your current auto insurance policy. The insurance company will use these documents to verify that you are a qualified driver and that you meet the state’s insurance requirements.

Moreover, you’ll want to do your due diligence when shopping for SR-22 insurance. Read customer reviews and ask for referrals from friends and family members. Additionally, make sure that the company is reputable and has a solid A.M. Best rating. Be sure to read the terms and conditions of the policy before signing up and ask the company about any discounts that they may offer.

Finally, once you have gathered all of the necessary documents and paperwork, you will be ready to begin the filing process. You’ll likely need to contact the company and let them know that you would like to purchase SR-22 coverage. Depending on the company you choose, this can usually be done over the phone or in person. Some companies may charge an additional fee for the filing, so be sure to ask about it in advance.

Once the filing process is complete, you’ll need to maintain continuous coverage for a certain period of time. Usually, this is three years but it can vary depending on your specific circumstances. If you allow your coverage to lapse during this time, then the filing will be revoked and you’ll have to start the entire process over again.

Now that you have a basic understanding of the process of getting SR-22 insurance in Texas, let’s turn to the other important aspects of this important process. What are the penalties for not maintaining continuous coverage? What should you do if your coverage is revoked? What is reinstatement and how does it work? We’ll answer these and other important questions here.

The penalties for not maintaining continuous coverage vary, depending on the severity of the infraction. Generally, if your coverage lapses, you may be subject to fines, license suspension, or other legal action, depending on the circumstances. Be sure to check with your insurance company or the state of Texas to determine the exact penalties you may face.

If your coverage is revoked, then you will need to begin the process of reinstatement. This usually involves a filing fee that must be paid to the insurance company or the state of Texas, depending on the circumstances. The company or the state will then review your application and if approved, they will issue you a new SR-22 certificate. Once this is complete, you’ll need to start over and maintain continuous coverage for the prescribed amount of time.

Finally, if you are having difficulty obtaining SR-22 insurance in Texas, you may qualify for assistance from a state program, such as the Texas Automobile Insurance Plan Association (TAIPA). This program is designed to provide access to insurance for drivers who have difficulty finding coverage on the open market. Be sure to talk to your insurance company or contact the TAIPA program directly to see if you qualify.

Getting SR-22 insurance in Texas doesn’t have to be overly complicated or expensive. With a little bit of research and preparation, you can be sure that you are getting the coverage you need at a price you can afford. So, now that you know the basics, why not take the first step towards getting the SR-22 coverage you need? Whether you are looking to get a policy from your current insurance company or shop around for other options, you can rest assured that you are well on your way to getting the peace of mind that you need.