The Lowdown on SR-22 Insurance in the Lone Star State

When talking about car insurance in Texas, one of the first things that come up is SR-22 insurance. This type of car insurance can have a huge impact on not only the cost of policy premiums but also on drivers’ ability to get back on the road. So, whats the lowdown on SR-22 insurance in Texas? Lets take a closer look!

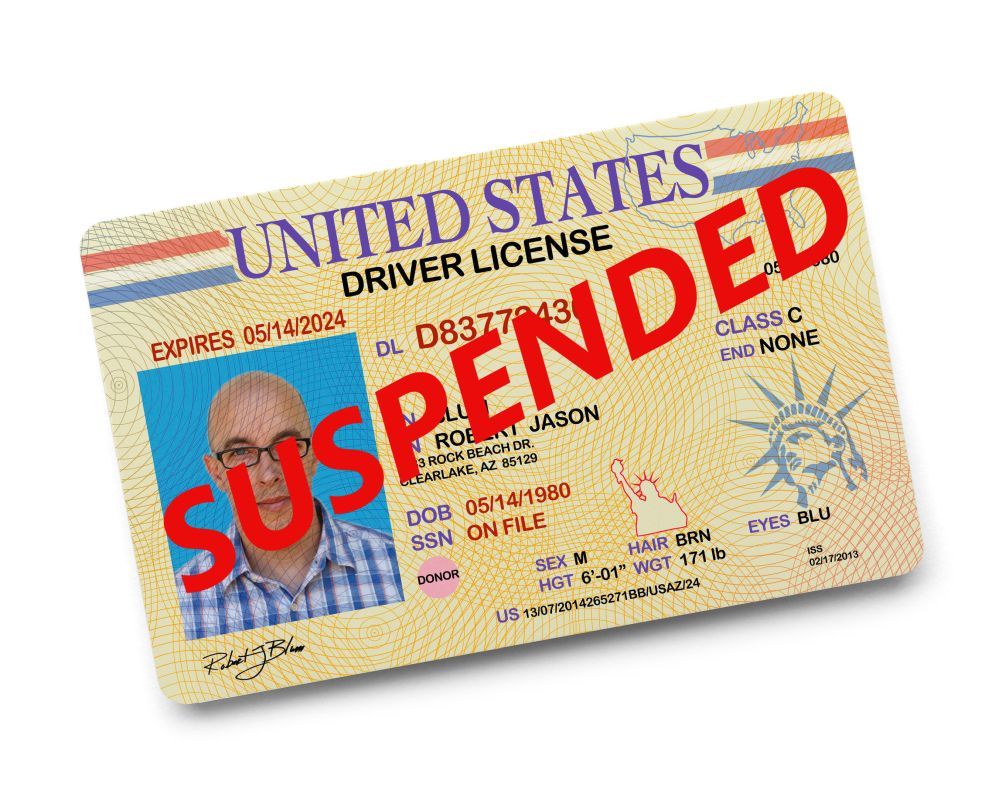

First of all, Texas SR-22 insurance is a financial responsibility form that must be carried on select vehicles. Its mandatory for drivers who have been convicted of certain offenses, such as driving while intoxicated (DWI), or for drivers who are deemed to be high-risk offenders. Once its obtained, the SR-22 is sent to the Texas Department of Public Safety. The Texas Department of Public Safety is then notified if the drivers policy is canceled or lapses and they are required to surrender the licence plates, registration and drivers licence in their holders name.

When shopping for car insurance, its important to note that in Texas SR-22 insurance is separate from the actual policy. This means that a separate SR-22 policy must be bought, in addition to the traditional auto insurance, in order to drive legally. Additionally, Texas SR-22 insurance can depend on several factors beyond the usual age, location and driving history. Specifically, the cost of a policy can vary depending on the severity of the previous infraction. As an example, low-level offenders will pay a much lower premium than those with multiple DWI charges.

How long must an SR-22 in Texas remain on file? Generally, its required for a minimum of three years, but that timeframe may be extended if the driver has been found guilty of another infraction during that time. As such, canceling an SR-22 policy prior to the three-year-mark will likely result in hefty penalties.

That said, its important to remember that, while SR-22 insurance isnt ideal, it can present an opportunity for drivers to get back on the road. Provided they adhere to the rules and regulations in their policy agreement, drivers can often get their license reinstated after the completion of their SR-22 policy.

Purchasing SR-22 insurance in Texas may seem overwhelming, but it can be made easier with the right knowledge. Drivers who are required to purchase SR-22 insurance should fully understand their policy and have a clear understanding of the risks associated with driving. This includes, but is not limited to, underage drivers, single-vehicle crashes, driving without insurance and reckless driving. Its also important that drivers understand any charges they may face if theyre pulled over or are involved in an accident, to ensure that their policy is in place and up-to-date.

In addition, Texas SR-22 insurance policies usually need to be backed up by vehicle insurance. That means that, along with the SR-22 policy, the driver must purchase traditional car coverage, such as liability, collision, comprehensive and uninsured/underinsured motorist (UIM). Purchasing the latter will usually require a minimum amount of coverage, depending on the severity of the offense.

Finding the right insurance provider for Texas SR-22 coverage and understanding the criteria in determining premiums can take some time. However, the knowledge gained in the process can be invaluable in keeping drivers safe and compliant now and in the future.

When it comes to Texas SR-22 insurance, its important for drivers to stay informed of the rules and regulations in their particular state. Doing so can help avoid costly fines and losses in the future.

Secondary drivers or passengers who have been involved in the same accident may also need to file SR-22 insurance in Texas to ensure that they are legally able to drive again. Thats why its important to thoroughly check the names listed on the owners policy agreement, so everyone involved has a clear understanding of the requirements.

Its also essential to remember that SR-22 policies can vary from one state to the next. If, for example, a person with a Texas SR-22 moves to another state, their policy may not be valid in their new home. Drivers should take the time to thoroughly research their policy and know the laws of the their state before they start driving.

Many Texas insurance agencies offer a range of car insurance policies and can also provide more information on SR-22 insurance in the state. In order to get the best quote and to find coverage that meets their individual needs, drivers should shop around and compare policies side-by-side. Doing so can help ensure that you get the best deal and the coverage that’s right for you.

Finally, filing an SR-22 usually results in higher premiums than standard car insurance policies, so drivers should be prepared for the added costs. However, for those with multiple breach of law offenses, it can be the only way to legally get back on the road.

When considering additional coverage for Texas SR-22 policies, drivers need to be aware of gaps in their policy. That means adding additional coverage for rental cars, towing services, third party liability and any other situation that may arise in the event of an accident or roadside emergency.

With the right information, filing SR-22 insurance in Texas doesn’t have to be so intimidating. As long as drivers keep up with their coverage and understand the laws in their state, they can get back on the road in no time.

When choosing a company to purchase an SR-22 policy from, it’s important to ensure that the company has an excellent reputation in the industry. Read customer reviews, compare quotes and check with the Better Business Bureau to make sure the company is legitimate.

It’s also important to look for discounts and policies that are tailored to the specific needs of the driver. That way, they can get the most coverage, while saving as much money as possible.

Cheaper coverage isn’t always better when it comes to Texas SR-22 insurance policies. That’s why drivers should pay attention to the amount of coverage they are actually getting for their money. That’s why having a trusted advisor can come in handy, so they can get the most out of their policy.

It’s important to remember that understanding the rules and regulations of car insurance in Texas can help ensure that you and your passengers are safe when you’re behind the wheel. Taking the time to double-check your policy and ask all the right questions can help make sure you have the right coverage and get back on the road quickly.

Apart from that, a Texas SR-22 policyholder is also required to keep proof of insurance in the vehicle at all times. This could be a paper or electronic copy of the policy or, if their policy is with a specific company, even a card that lists the policy number. It’s essential to show the proof whenever a law-enforcement officer asks for it.

It’s also essential to remember that driving with a SR-22 is a privilege, not a right. Failing to adhere to the conditions imposed on a policy, such as meeting all financial responsibility requirements or having points on your license, may result in policy revocation, fines and, in some cases, jail time.

As a final note, its important to understand exactly how SR-22 insurance works in different states, and how to avoid any legal repercussions from violating the law. Drivers charged with multiple offenses, DUI or DWI may be eligible for SR-22 insurance in Texas, but they must research what their exact requirements are, and how to comply with the states rules.

In terms of understanding the process of filing SR-22 insurance, here are some key points to remember:

* SR-22 insurance is not part of a traditional car insurance policy and must be purchased separately.

* In most cases, the SR-22 must be kept in force for three years or more.

* Failing to meet the financial responsibility requirements imposed on a policy could result in hefty fines and other legal repercussions.

* Secondary passengers must understand their responsibilities in the event of an accident if theyre covered by a Texas SR-22 policyholder.

* Comparing quotes from different insurance companies can help drivers save money and get the most coverage for their money.

For drivers who have been convicted of multiple offenses or who have been charged with DUI or DWI, understanding the requirements of SR-22 insurance in Texas is essential. Thats why its important to contact a qualified insurance agency, do some research on the policy conditions, compare quotes and make sure that you are fully prepared to meet the terms of your policy.

Ultimately, Texas SR-22 insurance can provide retribution for drivers who need it and it’s important to understand the rules and regulations involved in the process. With the right information, they can make the best choice for themselves and their policy.